It’s easier than ever to buy things these days. You don’t need to pull out cash, you don’t always need your wallet, and you can pay in installments instead of all at once.

For fintech and financial services, 2024 is set to be a landmark year. Payment trends like digital wallets, real-time payments, and contactless transactions are transforming how we pay.

Plus, payment technology is advancing faster than ever as more startups enter the sector to revolutionize a now traditional view of debit cards, credit cards, and cash.

Merchants benefit from a complete understanding of the modern payments landscape. It helps them to choose the right solutions to satisfy customers and streamline checkout operations.

So, what payment trends can you expect this year?

This post covers:

Cash has been steadily declining since the Pandemic—and it’s not slowing down. In their 2023 Findings from the Diary of Consumer Payment Choice, the Federal Reserve notes that cash makes up only 18 percent of all payments.

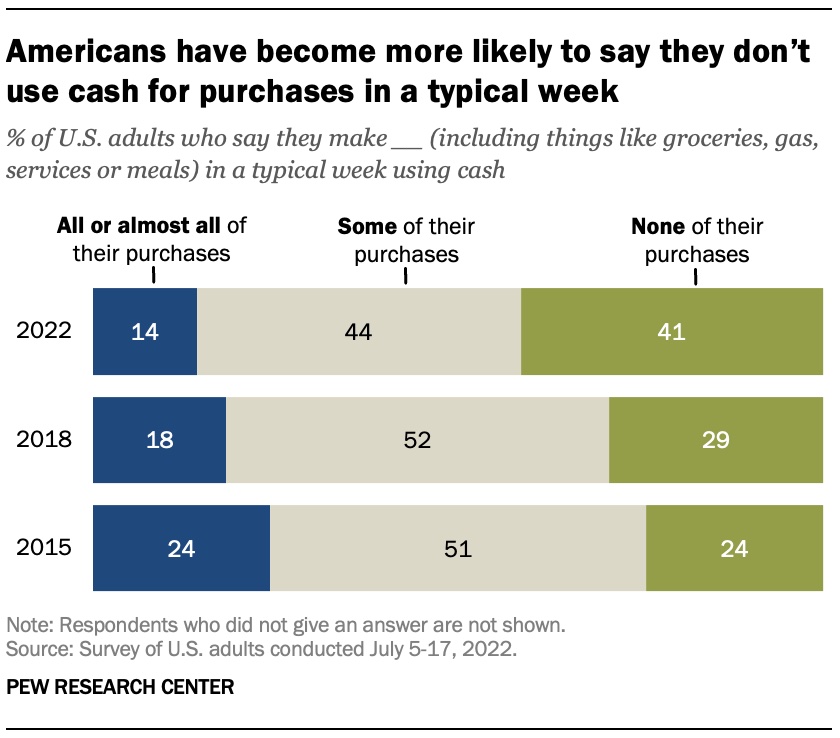

Many individuals are now leaning toward not even using cash at all. A study by the Pew Research Center found the share of Americans who go cashless in a typical week has increased by double digits in less than 10 years.

In 2024, physical cash will continue to be an afterthought for consumer payments. Shoppers won’t be carrying cash around and won’t expect to need physical currency in most situations.

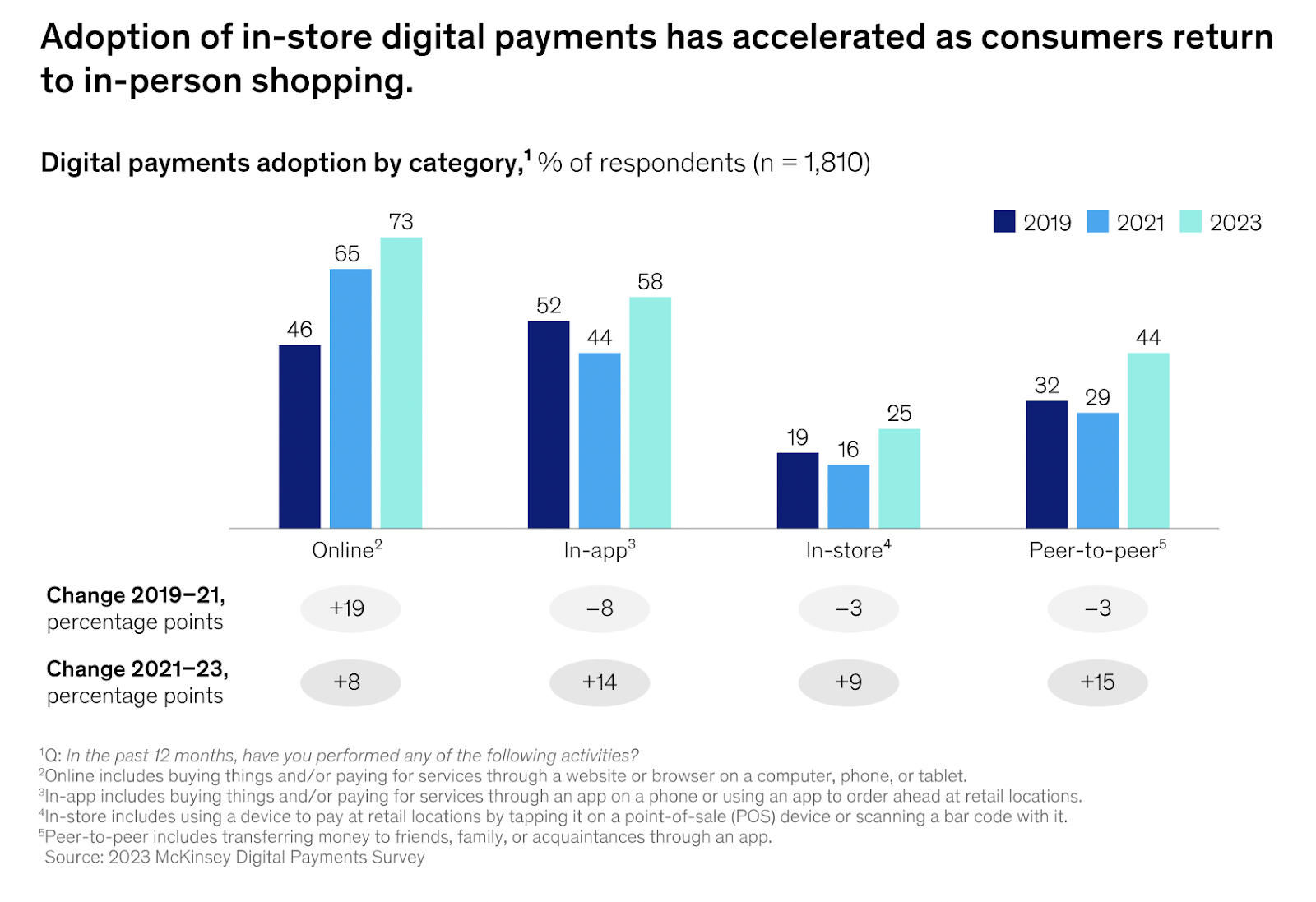

The emergence of digital payments in recent years has revolutionized how people pay. Digital transactions are commonplace for more than nine out of ten consumers (according to a survey by McKinsey) who say they used some form of digital payment over the year.

While Apple Pay and Google Pay are among the most used digital transaction payment options, there are now more choices than ever. This means merchants can find solutions that best fit their use case.

Unlike traditional payment methods, options like contactless payments, mobile wallets, and mobile payment methods are gaining widespread popularity for their simplicity at the point of sale. Though online ecommerce payments are leading the way, there’s also notable growth for in-store digital payments, as a quarter of McKinsey survey respondents are now digital adopters.

In 2024, expect to see digital payments become standard. Large and small businesses will adopt cash/card alternatives, and more consumers will realize the convenience of the emerging payment method.

Account-to-account (A2A) payments—the ability to send funds instantaneously from a consumer bank to a merchant account—are on the verge of reaching widespread adoption.

Fintech payment systems like digital wallets, online payments, and P2P payments (like Venmo, Cash App, or PayPal) are gaining popularity, but they haven’t reached their potential yet. In fact, pay-by-bank is only used by 36% of U.S. consumers, according to a survey by PYMNTS.

That’s going to change in 2024.

In reality, 36% of consumers don’t understand how A2A payments operate, and another 24% are unaware the option exists. As more merchants offer and incentivize the option, and more consumers learn and try A2A for themselves, adoption rates will grow quickly.

Demo Aeropay A2A payments for your business

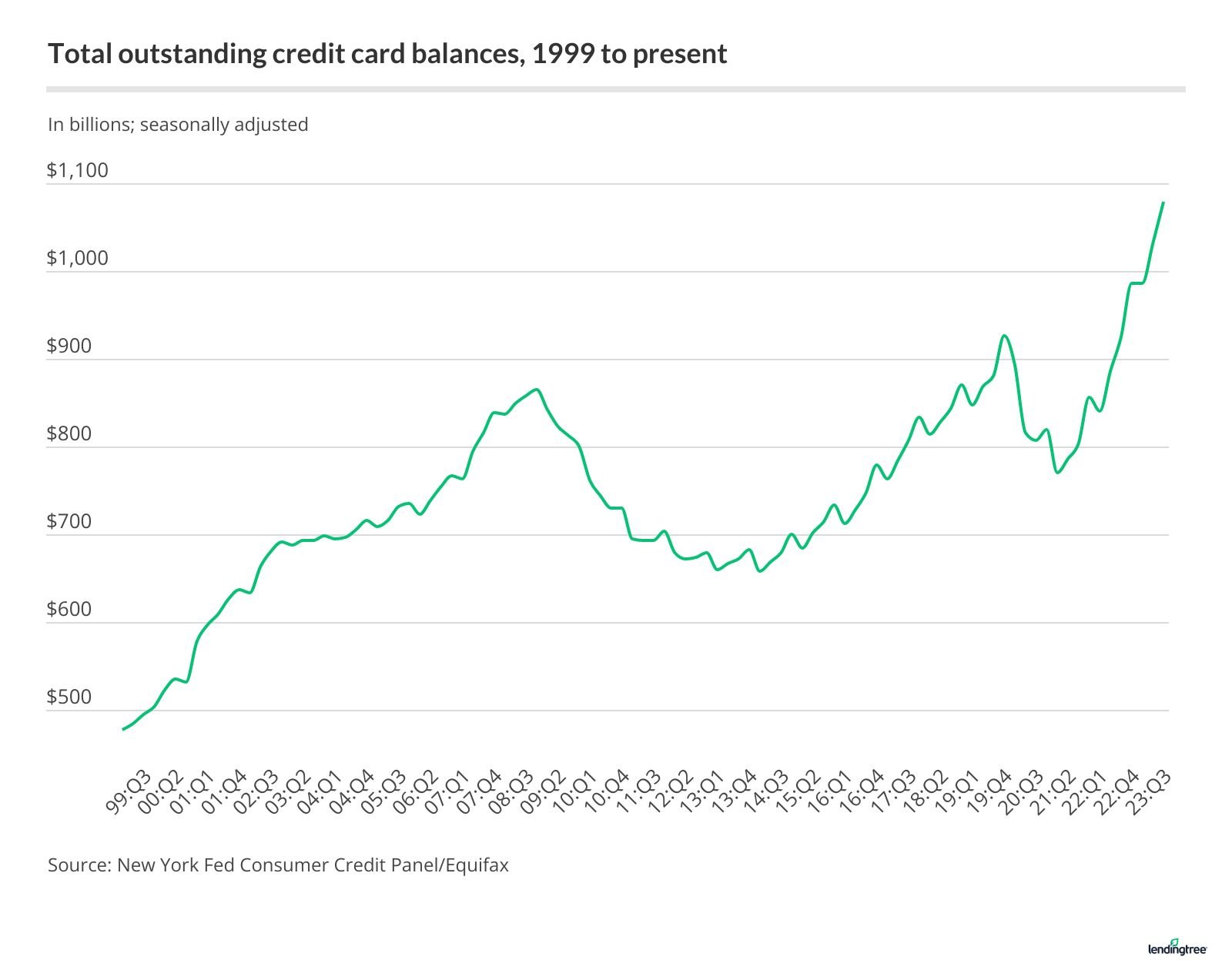

American credit card debt is at a record high. In Q3 2023, the total US credit card balance was $1.079 trillion, according to the latest consumer debt data from the Federal Reserve Bank of New York.

In 2024, expect the average $6,993 of credit card debt per cardholder to rise. At the same time, it’s worth noting that total debt is climbing, but delinquency rates are near historic lows. This means consumers are using credit cards but paying off their balances each month on time.

As long as the economy remains (relatively) stable and credit cards remain accessible and highly marketed, demand and consumer debt will keep rising.

Open banking involves providing third-party payment services open access to consumer bank accounts, transactions, and financial customer data from banks via API.

Some common use cases of open banking include:

The concept of open banking is a game changer for modern banking and payments functionality and will continue to shake things up in the near future.

Buy now, pay later (BNPL) divides a payment into multiple installments so consumers don’t have to pay all at once.

This form of short-term financing is catching on quickly as the 50 million buy now, pay later users America had in 2021 is set to exceed 94 million by the end of 2024.

While BNPL is an effective option for consumers who want to afford products more easily, it has been criticized for inflating spending habits for consumers who can’t actually afford what they’re buying.

Additionally, the cost associated with BNPL typically sits around 2-8%.

Still, this trend unlocks a new world of potential buyers who were originally priced out of some product categories. Expect BNPL to continue rising in 2024.

The rise of automated intelligence (AI) or “machine learning” is a game changer for virtually every modern sector, including the payments industry.

In 2024, financial institutions will leverage AI to detect financial fraud, effectively enhancing their current detection methods and stopping payment fraud before it happens.

Similarly, biometric authentication methods like fingerprint and facial recognition are rising options to ensure safer payment processing while enhancing the payment experience. Expect to hear more about biometric payments in 2024 and the coming years.

As a leading digital payment provider, Aeropay offers reliable instant payments for in-store and e-commerce business transactions nationwide.

Businesses using Aeropay experience:

The simplicity, security, and efficiency of Aeropay make it an easy choice for your customers—and your business.

Schedule a 15-minute demo to see our full payment solution and make bank-to-bank transfers work for your business.