Win more

Convert 20% more users with API-based financial connectivity that builds trust and onboards new users in seconds.

Sell more

Increase ACH approvals and reduce returns with verified accounts and real-time balance validation.

Earn more

Lower payment costs and protect revenue with built-in verification, fraud controls, and scalable bank infrastructure.

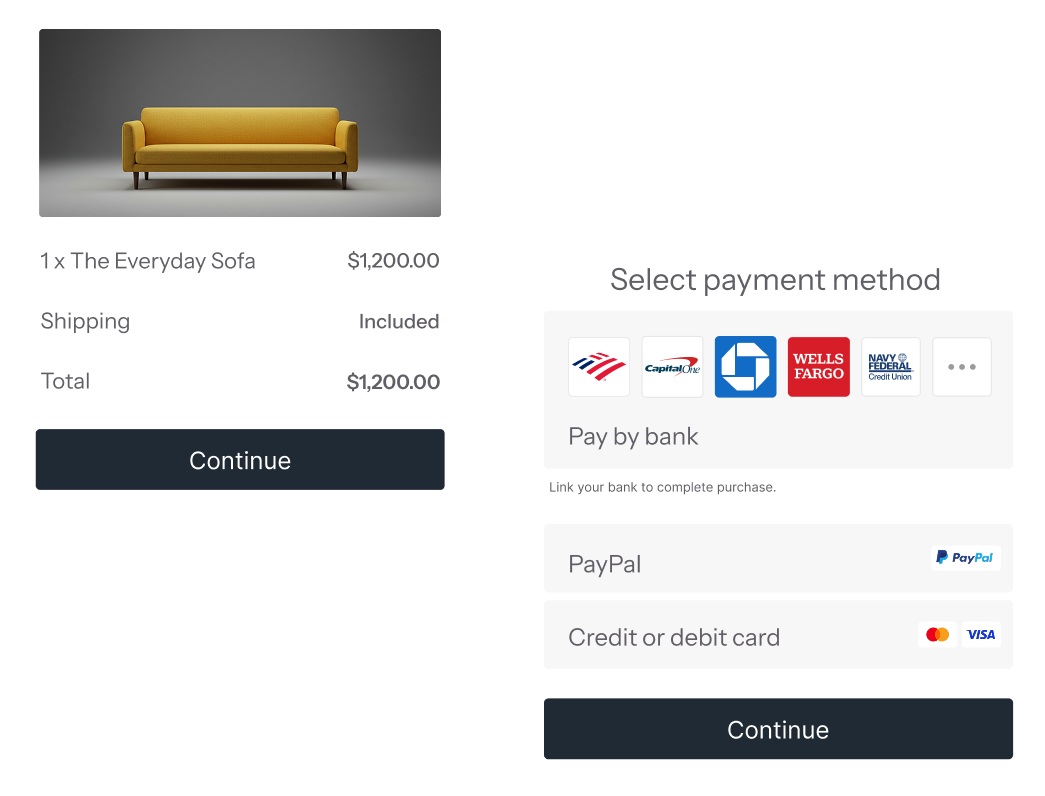

Aerosync user experience

With Aerosync’s embedded flow, new users quickly and safely log in to their bank account to set up ACH payments.

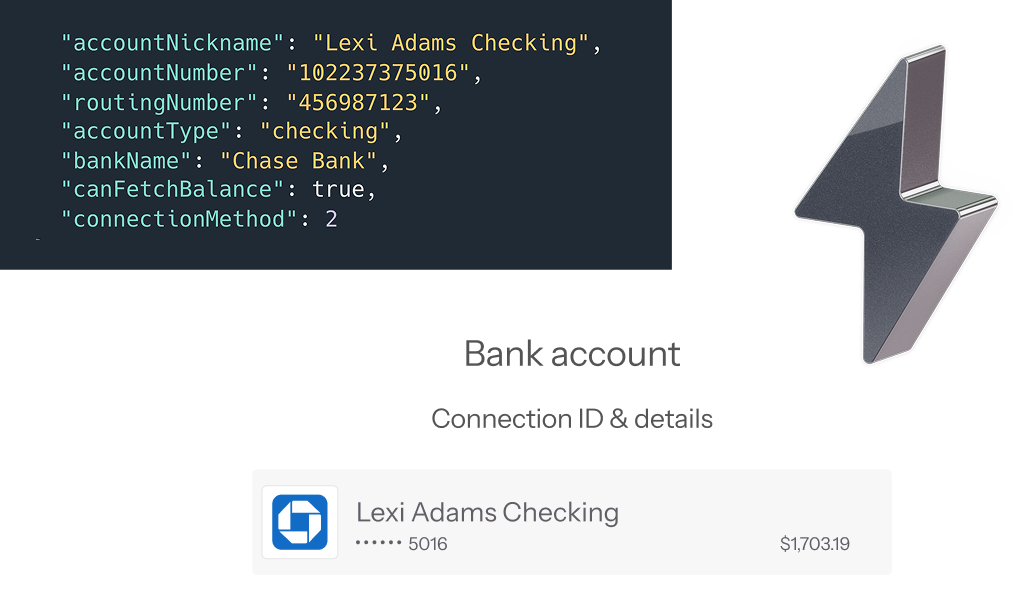

1. Connect a bank account

Users securely log in to their bank through an embedded, API-based flow to authorize ACH payments.

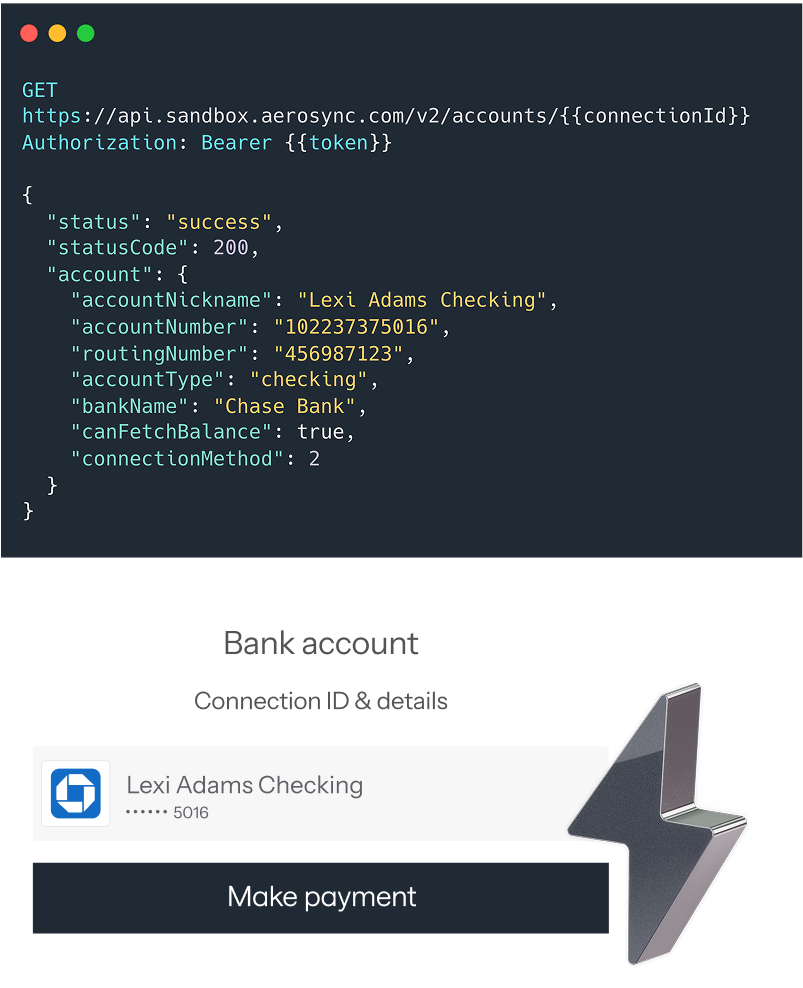

2. Verify and validate

Aerosync verifies account details and refreshes balances before initiation to reduce errors and failed payments. Bank credentials and account details are encrypted and tokenized, so sensitive data is never exposed.

.png)

3. Build lasting adoption

One secure connection powers every future transaction, reducing friction and improving payment performance over time.

From conversion to retention, faster

.png)

Leading bank coverage, zero screen scraping

.png)

Remove risk from bank payments

One powerful pay by bank network

Adding Aerosync means joining Aeropay’s national network of verified users. No re-linking necessary.

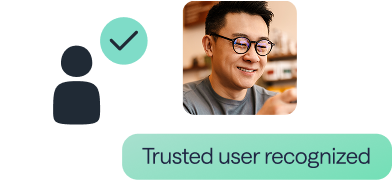

Instant recognition

No re-linking required. Users verified once with MFA or biometrics stay recognized across your app.

Millions of connected accounts

New users may already be in the network, cutting onboarding time down to seconds.

Frictionless re-entry

Enable secure re-authenticate to save bank payment details for next time.

Aerosync is perfect for

Marketplaces

Instantly verify seller and worker accounts with OAuth-first connections, reducing onboarding drop-off and ensuring payouts flow smoothly from day one.

Subscription apps

Access real-time balances before debiting funds, cutting failed ACH returns and keeping subscriptions running without costly interruptions.

Fintech platforms

Retrieve balances, account numbers, and identity details in real time to streamline KYC, compliance, and risk checks.

Build & ship payment-ready financial connections

Tailor the linking experience to match your branding, risk controls, and use case.

Start with clear, lightweight code

Get the bank linking widget live in minutes. No heavy infrastructure, just drop it in and start testing.

Add your brand

Apply your colors, font, and style to make the entire experience yours.

Handle OAuth out of the box

Allow your users to connect directly to their preferred institutions. No screen scraping necessary.

Retrieve bank details in one call

Once a bank is linked, retrieve data from the user's connected account. Balance, transaction history, and identity can be retrieved within seconds.

Add multiple configurations

Easily A/B test and segment users, control which banks show up, and tailor flows to fit different use cases.

Easily optimize for mobile

Aerosync supports app-to-app login, deep linking, and native biometrics, so bank linking feels as seamless as your mobile app.

.png)