Table of contents

Introduction

There were 8.3 billion ACH payments in the second quarter of 2024, an increase of 6.3% over the same time period in 2023. The dollar value of these ACH payments totaled $21.6 trillion, a 7% increase.

ACH payments are growing in popularity because they lower cost for merchants and streamline user experience for consumers.

This merchant guide contains all the information businesses must know about ACH transfers.

You'll learn:

- What is an ACH payment and the ACH Network

- Key participants in ACH transfers

- ACH credit vs. debit

- Step-by-step process of ACH transfers

- ACH settlement timing and batching

- Costs associated with ACH payments

- How to reduce ACH payment fees

- ACH returns and how to prevent them

- ACH notifications of change and how to minimize them

- How merchants can use ACH today

- ACH best practices

- The future of ACH payments

- Getting started with ACH

What is an ACH payment?

ACH payments electronically move money from one bank account to another. ACH is also called direct debit, EFT, electronic bank transfer and eCheck.

The actual ACH system was created back in the 1970s by the Federal Reserve Bank System as an alternative to paper checks. Now, its adoption is being accelerated by pay by bank and open banking.

“ACH” stands for Automated Clearing House, a network that’s operated by the National Automated Clearing House Association (NACHA). Banks and credit unions send and receive electronic payments through this ACH network.

Put simply, the ACH network ensures these direct payments get from point A to point B safely and efficiently.

Businesses of all sizes are increasingly choosing ACH payment systems over traditional cash, cards, and paper checks due to key advantages like:

- Lower processing fees

- Faster settlement times

- Reduced risk of fraud, failures, and chargebacks

- Improved cash flow management

- Reduced administrative costs

As a bonus, ACH payments satisfy modern consumer demands for efficient digital transactions, contributing to improved satisfaction, loyalty, and potentially higher customer retention rates.

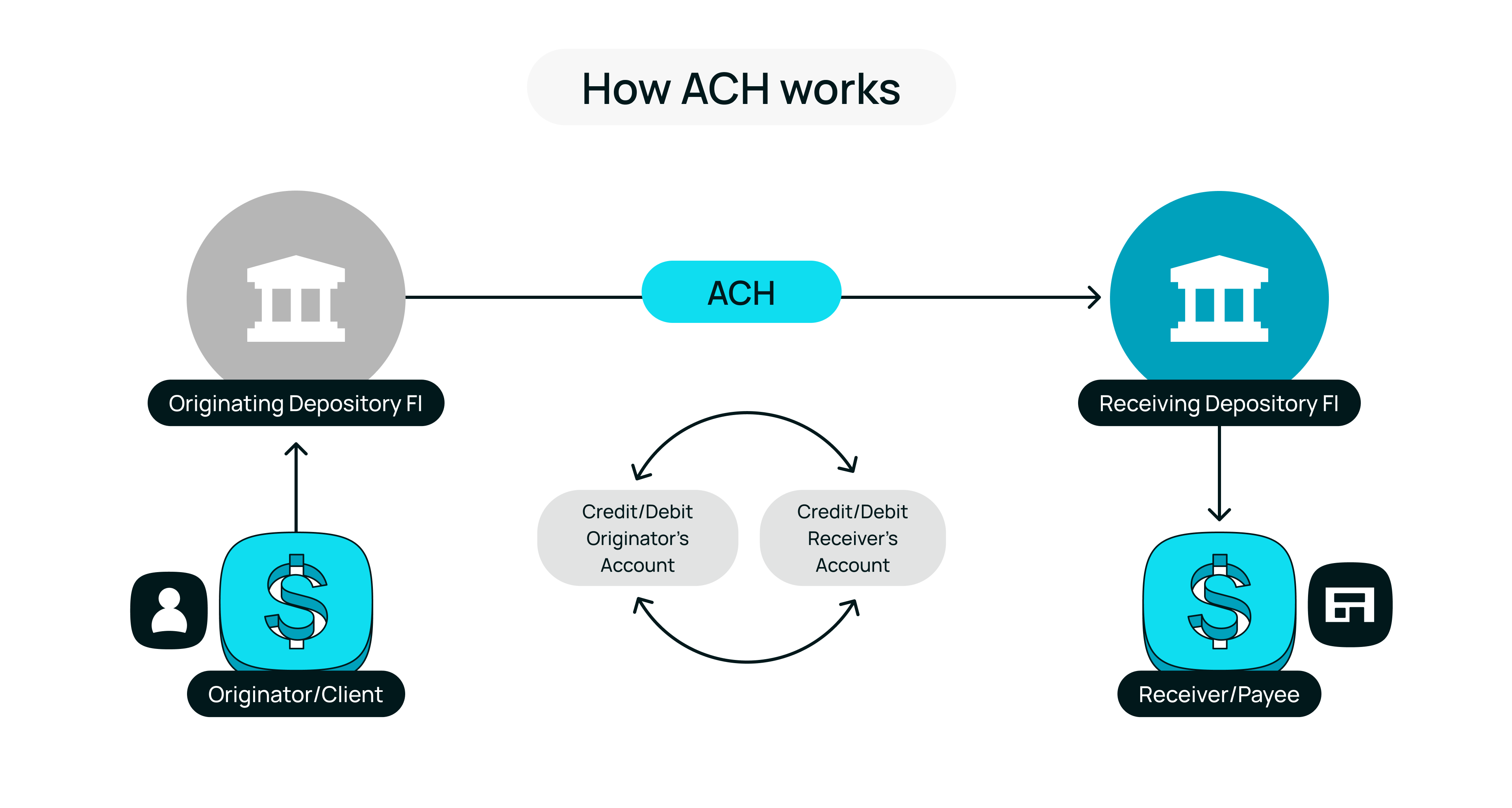

Who is involved in an ACH transaction?

Every ACH transfer begins as an ACH entry, an electronic instruction containing essential transaction details including:

- Transaction amount

- Account numbers for both the originator and receiver

- Transaction type (ACH credit or ACH debit)

- Payment purpose

ACH money transfers involve five key participants

- Originator: The entity initiating the transaction (business or customer).

- ODFI (Originating Depository Financial Institution): The originator's bank, which initiates the ACH entry.

- ACH Operator: The Federal Reserve or The Clearing House, the central facility for the clearing, delivery, and settlement of ACH entries.

- RDFI (Receiving Depository Financial Institution): The receiver's bank, which receives the ACH entry and credits or debits the Receiver's account.

- Receiver: The party whose account is being credited or debited (business or customer).

In some cases, additional parties like Third-Party Senders or ACH Software Providers may also be involved in the ACH payment processing.

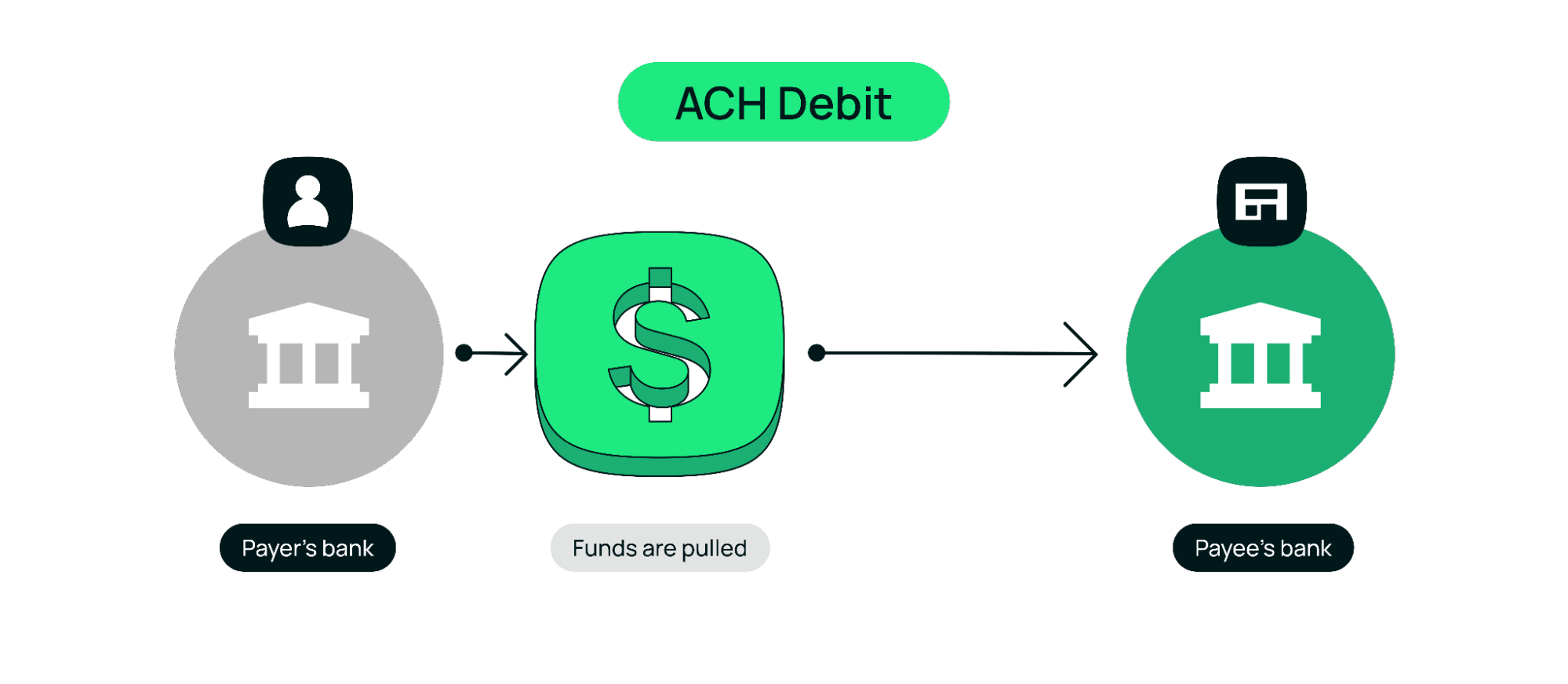

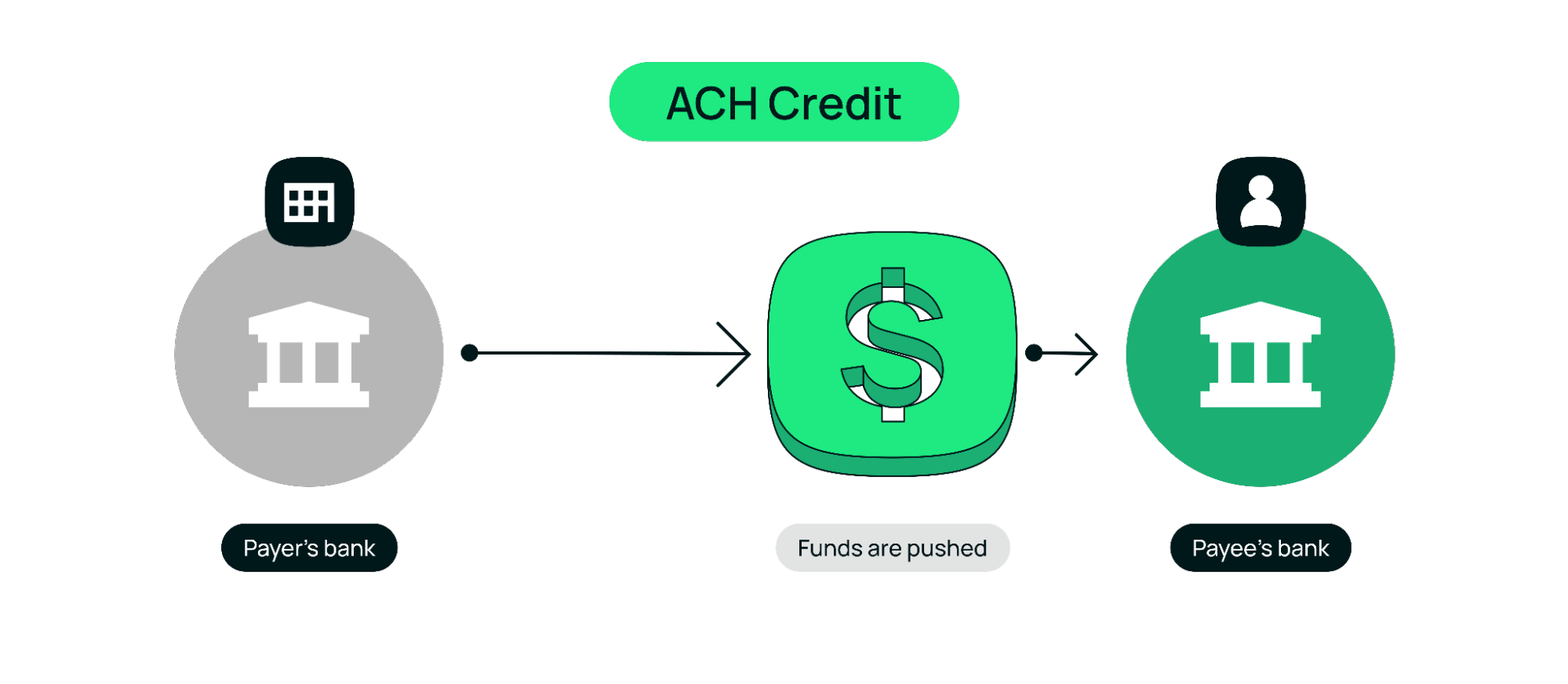

There are two types of ACH transfers, ACH credit and ACH debit

ACH transfers are either credits or debits, depending on which direction money is flowing and who initiates the transaction.

An ACH debit transaction is a Merchant-Initiated transaction that "pulls" money from a payer's bank account. Common examples of ACH debits include recurring bill payments and one-time purchases.

An ACH credit transaction is a Customer-Initiated transaction that "pushes" money from a payer's bank account. Common examples of ACH credits include online ACH rent payments and direct deposits for payroll.

How ACH transfers work:

- Initiation: An Originator initiates an ACH transaction (debit or credit).

- ODFI processing: The Originator's bank receives and batches ACH requests.

- Submission to ACH Network: The ODFI submits batched requests to an ACH Operator.

- ACH operator processing: The Operator sorts and processes transactions.

- Distribution to RDFIs: The Operator sends sorted transactions to receiving banks.

- RDFI Processing: Receiving banks process transactions, crediting or debiting accounts.

- Settlement: Funds are settled between financial institutions.

- Completion: The transfer is completed, with funds available in the recipient's account.

ACH transfers typically take 1-3 business days to process, depending on the ACH transfer type and processing schedule.

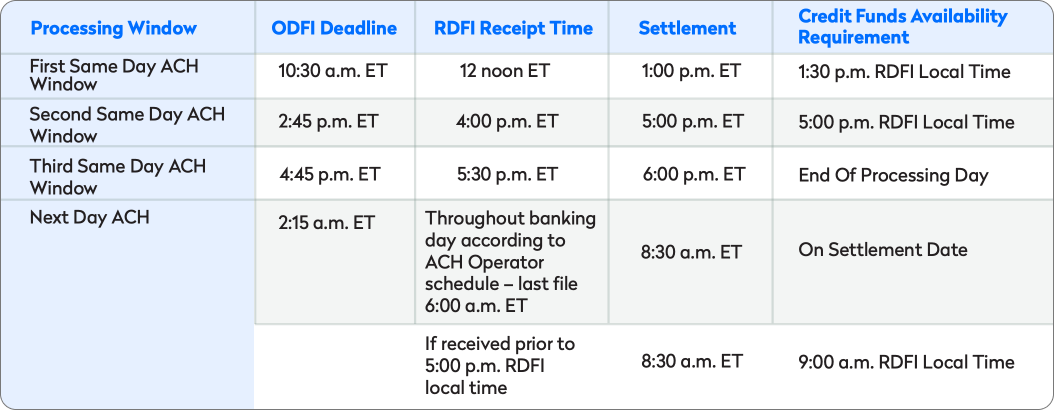

ACH settlement timing and batching

To process funds, the ACH network uses batch processing, grouping transactions at set intervals during business days.

Two types of ACH transactions exist:

- Standard ACH transactions are processed in regular batches at regular intervals during business days and typically settle within 1-3 business days.

- Same-day ACH allows for same-day processing and settlement but comes with higher fees and has three processing windows with strict deadlines.

ACH payment processing fees

ACH payments offer significant cost savings compared to other methods, making them an attractive option for businesses looking to optimize their transaction fees.

Typical ACH fee structure includes:

- A base network fee. Fractions of a cent per transaction

- A standard processing fee. Flat fee, usually under $1

- A micro-transaction fee. Lower flat or percentage-based fee

- A high-value transaction fee. Percentage-based, often capped at $5

- A same day ACH fee. Slightly higher cost for faster processing

To put these costs into perspective, let's compare ACH to other payment methods.

ACH vs. credit cards

Credit cards are very common and popular with consumers, but they’re expensive for merchants. For example, rent collection for landlords can be much more expensive when they allow credit card payments vs. accepting ACH payments.

The fee structure associated with credit card processing depends on factors like;

- whether the card is present (in-store) or not present (online) for the transaction,

- rewards associated with the particular card used,

- transaction location, size and volume,

- and more.

Below is a comparison of average ACH costs vs. credit card costs (based on an average 2.9% + $0.30 card processing fee).

.png)

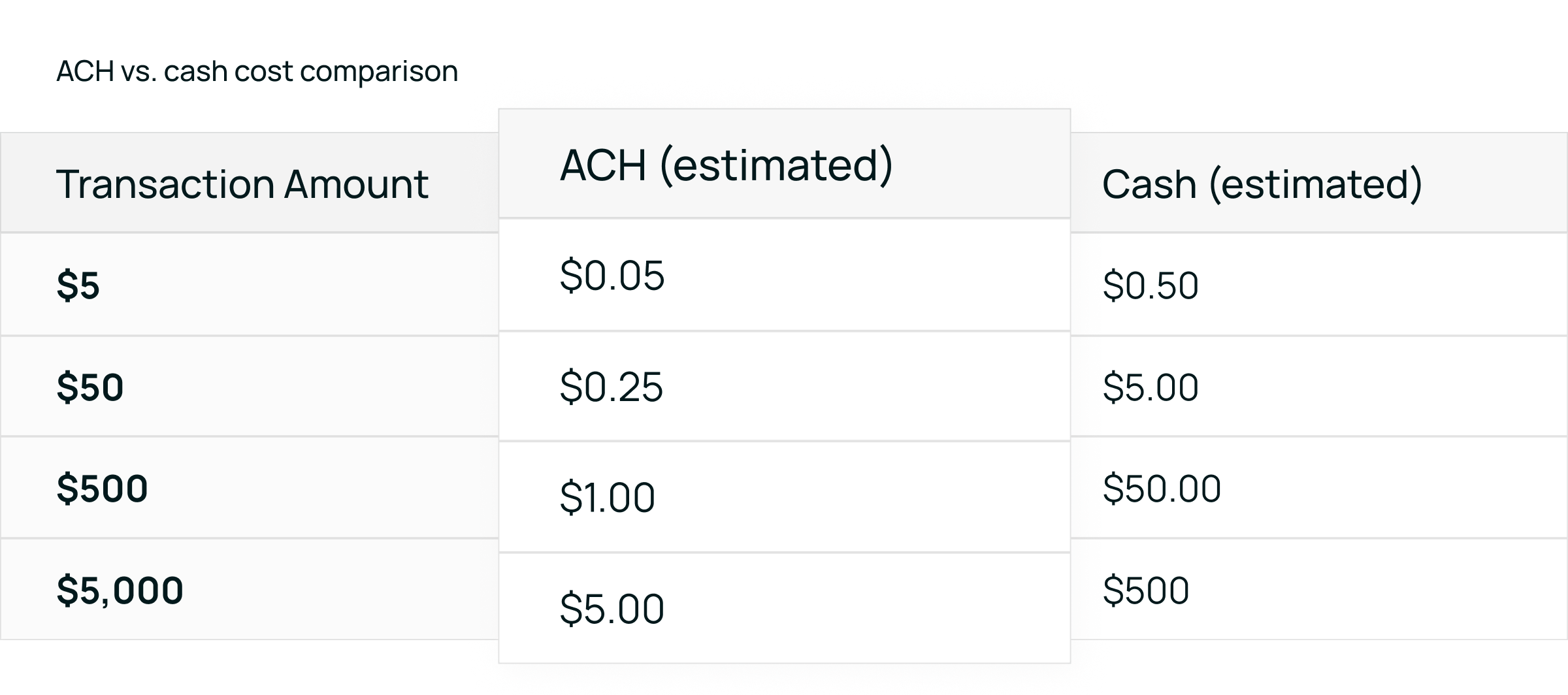

ACH vs. cash

While cash transactions don’t involve transaction fees, they come with other costs. One report from IHL Group shows retailers’ cash-handling costs range from 4.7% to 15.3%.

Common costs associated with cash include;

- slippage (rounding errors),

- theft (both external and internal from employees),

- cash pick up security (armored trucks),

- cash handling fees (charged by banks for depositing),

- and more.

For both small and large values and volumes, ACH is a payment solution that pays for itself.

Still, here's how you can minimize ACH processing fees further:

- Negotiate rates with your payment processor based on volume

- Implement account validation to reduce return fees

- Optimize your billing cycles to process payments in larger batches

ACH returns and Notifications of Change

When an ACH entry cannot be processed, it's sent back to the originating financial institution as an ACH return. Each return has a corresponding three-digit ACH Return Code, displayed in the processor's dashboard, which identifies the specific issue and communicates the reason for the rejected entry.

Here are the most common ACH return codes:

- R01 – Insufficient Funds

- R02 – Account Closed

- R04 – Invalid Account Number

- R05 – Unauthorized Debit Entry

- R06 – Returned Per ODFI Request

- R07 – Authorization Revoked by Customer

- R08 – Payment Stopped

- R09 – Uncollected Funds

- R12 – Branch Sold to Another DFI

- R14 – Representative Payee Deceased or Unable to Continue

Understanding ACH return codes helps merchants quickly address issues, communicate with customers, and avoid potential penalties from unresolved problems.

Best practices to prevent ACH returns

To minimize ACH returns and enhance payment security, merchants can:

- Validate account and routing numbers before initiating ACH transfers.

- Secure explicit customer consent for ACH debits.

- Regularly verify account details to keep customer information current.

- Use intelligent retry systems that attempt payment collection at optimal times.

- Regularly analyze ACH return data to identify and address recurring issues.

- Use Same Day ACH for time-sensitive transactions to reduce the likelihood of insufficient funds returns.

Notifications of Change (NOCs)

Unlike ACH returns, NOCs are informational messages sent when ACH entry information is outdated or incorrect.

Here are some of the most common NOC codes:

- C01: Incorrect bank account number

- C02: Incorrect transit/routing number

- C04: Bank account name change

- C05: Incorrect payment code

- C09: Incorrect individual ID number

- C10: Incorrect company name

- C11: Incorrect company identification

- C12: Incorrect company name and company ID

ACH transactions with NOCs typically process as expected, but Nacha operating rules require updating customer records within 6 business days of receiving a NOC.

To minimize NOCs:

- Thoroughly verify new customer account details

- Regularly review and update customer account information

- Use account validation services to verify account and routing numbers

Benefits of ACH for businesses

ACH payments are gaining momentum in the United States because they’re a simple solution to complex payment issues that have existed in this country for decades.

Certain use cases are catching on faster than others, like:

- Subscription payments. Recurring payments are much easier with ACH because bank information is rarely changed (compared to card numbers). Consumers can “set and forget” their subscription payments without hassle.

- Bill payments. ACH is a convenient, affordable way to pay bills on time without a need for paper checks or money orders.

- Direct deposit. Employers leverage ACH credits to send out paychecks.

- Online gaming. ACH enables easier withdrawals and one-click deposits to streamline the flow of player funds.

- Alternative wellness. ACH offers compliant digital payments in the cash-reliant, heavily regulated alternative wellness industry

- Government. Tax refunds and government aid are sent via ACH electronic funds transfer directly to consumer bank accounts.

ACH advantages for businesses

Here's why more businesses are using ACH each day.

Higher conversion and approval rates

ACH allows first-time consumers to log in to their bank account to pay. For future transactions, payment can be completed in a single click—removing friction at checkout.

Durable payment information

On average, Americans have the same bank account for 17 years, compared to only 2-3 years for cards. Allowing customers to link their bank account for payment maintains accurate payment details for much longer.

Lower cost

ACH is one of the most affordable payment methods for merchants. Most payment-related costs are interchange fees, which ACH completely eliminates.

Because of bank-level security protocols, real-time authentication, and other fraud reduction measures, ACH eliminates chargebacks and reduces disputes.

ACH advice for merchants

ACH payments aren't just for standard transactions, they offer versatility across various business needs, like:

- Customer payments: One-time purchases and recurring billing

- Business operations: Vendor payments, payroll, and expense reimbursements

- Financial management: Refunds, account-to-account transfers, and tax payments

If you’re considering or currently using ACH for payments, keep these best practices in mind:

1. Proactively combat ACH fraud

While ACH is generally more secure than wire transfers and credit and debit card transactions, fraudsters still try to find ways to circumvent security.

You can combat fraud related to ACH transactions by:

- Developing and implementing fraud protocols. This should include steps for investigating potential fraud, notifying affected customers, and working with financial institutions to resolve issues.

- Restricting access to systems and information based on the principle of least privilege. Only those employees who need access to ACH processing systems should have it, and their activities should be regularly monitored.

- Making sure your software and systems are regularly updated and patched. This helps protect against known vulnerabilities that fraudsters might exploit.

- Using multi-factor authentication (MFA). This added layer of security makes sure only authorized individuals can initiate or approve ACH transactions.

- Using biometric authentication. While often thought of as a convenience factor, biometric authentication also helps prevent fraud. For existing accounts, it stops account takeovers by maintaining authorization.

- Watching for suspicious activity. Be mindful of high dollar purchases, especially completed by the same individual on the same day or over the course of a few days. Multiple hundred dollar purchases in close time frames are typically outside of the natural buying behavior/consumption for individuals.

2. Maximize customer adoption

The more your customers use ACH to pay, the more you’ll save on fees associated with other payment methods.

Encourage more customers to use ACH payments with:

- Education. Let your shoppers know about the benefits of ACH payments, such as lower fees, greater security, and the convenience of direct bank transfers. Use marketing materials, in-store signage, and website information to highlight these advantages.

- Incentivizes. Offer incentives for customers who choose ACH payments over other methods. This could include discounts, loyalty points, or other rewards that make ACH more attractive.

3. Choose the right ACH partner

You need an ACH partner that’s evolving with payment services. Pay by bank is the future of money movement because it uses ACH rails alongside real-time payment networks.

By implementing an ACH solution that’s built for the future, you’ll capitalize on the fastest rails available based on each user’s bank.

The future of ACH payment processing

The ACH network is evolving. Faster transfer of funds availability, higher transaction limits, and extended hours all mark significant advancements in the efficiency and flexibility of the system, benefiting businesses of all sizes.

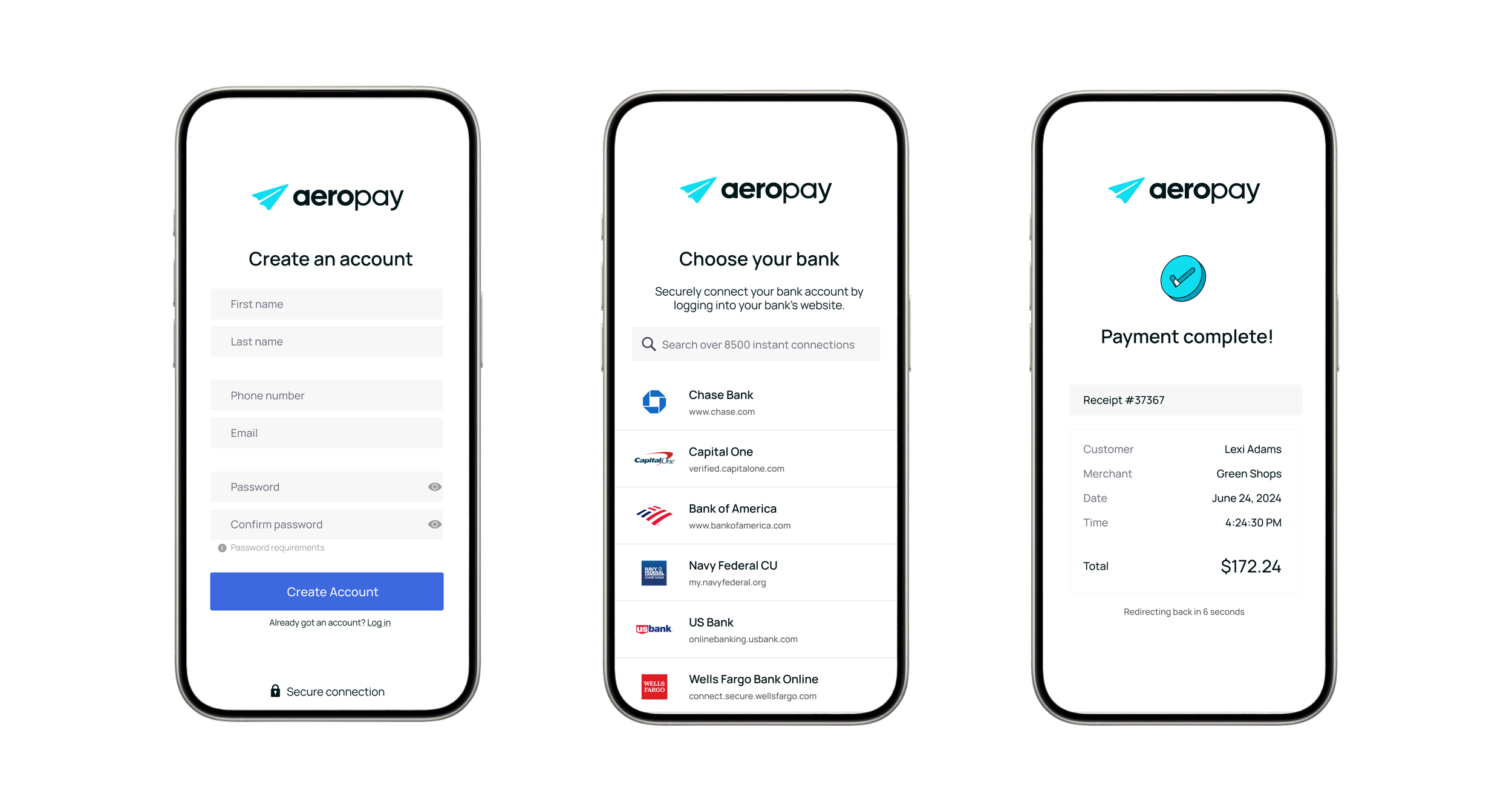

Aeropay, a leading digital payment provider, offers reliable ACH payments nationwide.

Businesses using Aeropay see:

- 25% higher customer spend

- 30% increase in completed online orders

- 70% increase in returning online customers

Experience the simplicity and efficiency of Aeropay's ACH solutions. Contact an AHC expert to see how Aeropay can support your business, lower costs, and improve overall cash flow management.