Table of contents

Introduction

The open banking concept has already swept many parts of the globe, now it’s positioned to do the same in the US.

Read this guide to learn:

- What open banking is

- Why it’s important

- How open banking works

- Who open banking helps

- Use cases

- Open banking in the US

- The future of open banking

What is open banking?

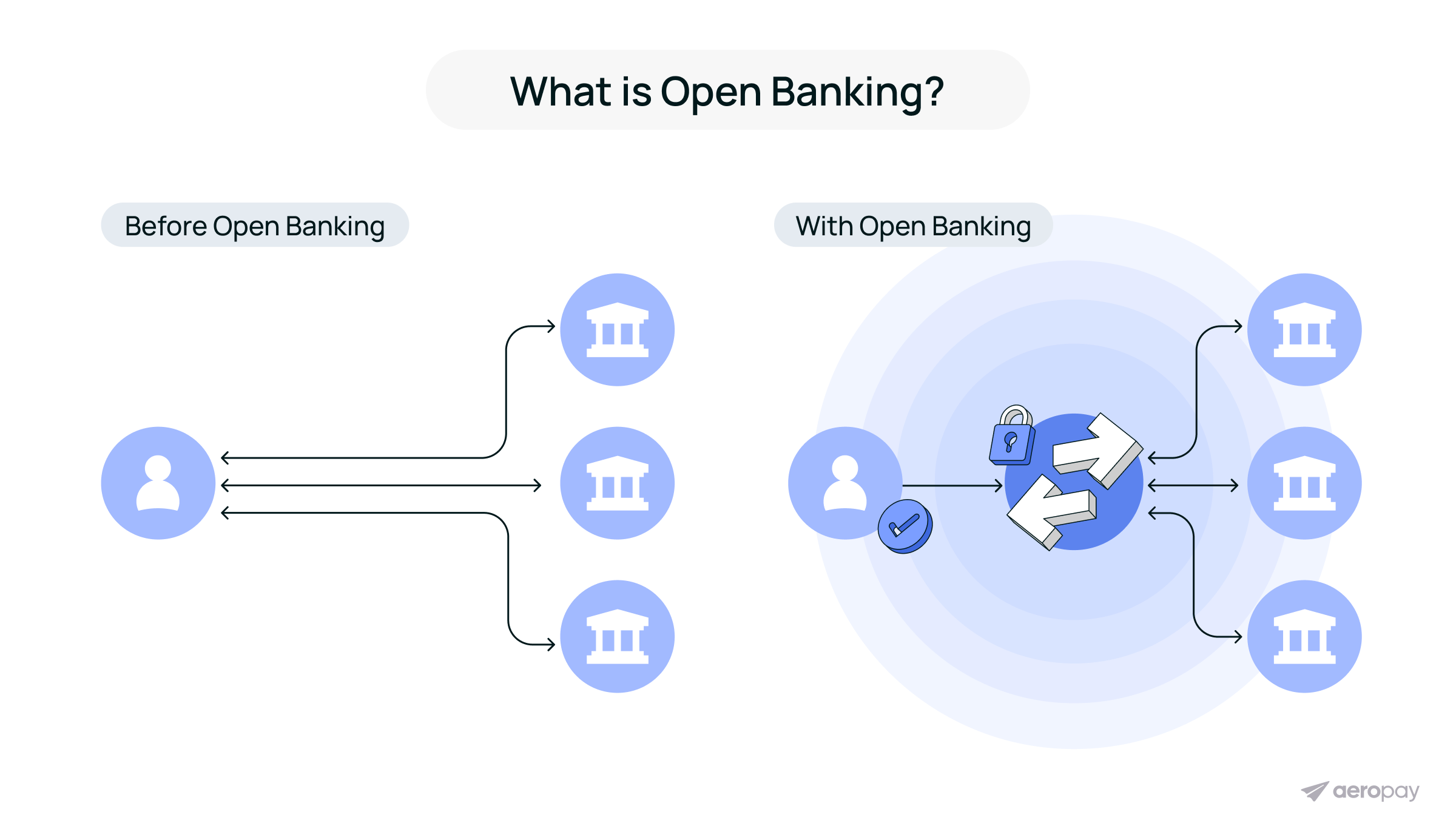

Open banking, also known as “open bank data,” is a financial model where consumer banking, transaction, and other financial data is opened for access to third-party providers (TPPs) via application programming interfaces (APIs).

With consent, customer data securely moves from banks and non-bank financial institutions to TPPs that layer on financial enhancements or initiate payments directly from the account.

The open banking model empowers consumers as true “owners” of their data — providing them greater transparency and control. It also sparks a democratization of data accessibility for merchants and financial service providers, driving competition and innovation in the sector.

Under open banking, there is considerable opportunity to create a new generation of banking and financial services that are transparent, inclusive, and highly digital.

Takeaways:

- Open banking is a financial model providing open access and control of consumer financial data via APIs.

- Data sharing between banks, FIs, and third-party providers will help foster innovation and competition.

- The United States is about to officially adopt open banking best practices, meaning US banking, payments, and financial services are going to evolve.

Why is open banking important?

Open banking aligns with the trajectory of modern technology and its impact on society. As the world becomes more digitally connected, so too must the systems surrounding financial data and money movement.

Already, the US (along with much of the world) has seen a shift in the way consumers pay, get paid, bank, invest, and more:

- Digital payments are the most used payment method in the US today.

- 86% of businesses and 74% of consumers said they used faster or instant payments in 2023.

- As of January 2024, 48% of borrowers received consumer loan disbursements via instant payment methods — a 15% increase year over year.

- In 2023, over 66% of the US used online banking.

Open banking further enhances financial technology, unlocking full data access for third-parties to build robust, inclusive systems within, on top of, and in line with existing institutions in the US.

How open banking works

Open banking decentralizes traditionally fragmented banking industry data, enabling seamless connectivity for financial services.

Open banking creates standardized data formats and secure communication protocols for FIs and TPPs. This levels the playing field for third-parties to integrate with any and all banks / FIs under uniform rules, regulations, and technical standards.

Open banking works by enabling TPPs to access consumer payment, transaction, identity, and other financial data from banks and non-bank financial institutions through Application Programming Interfaces (APIs). This granular access is provided with the consent of the consumer, creating a more connected and competitive financial ecosystem.

Here’s a look at the process:

- Consumer consents to share their financial data with a third-party provider through a secure app or service.

- APIs securely exchange data between the consumer's bank and the third-party provider.

- The TPP can access banking data such as account/routing numbers, account balances, and transaction history to offer personalized financial services or initiate payments.

The role of bank aggregators

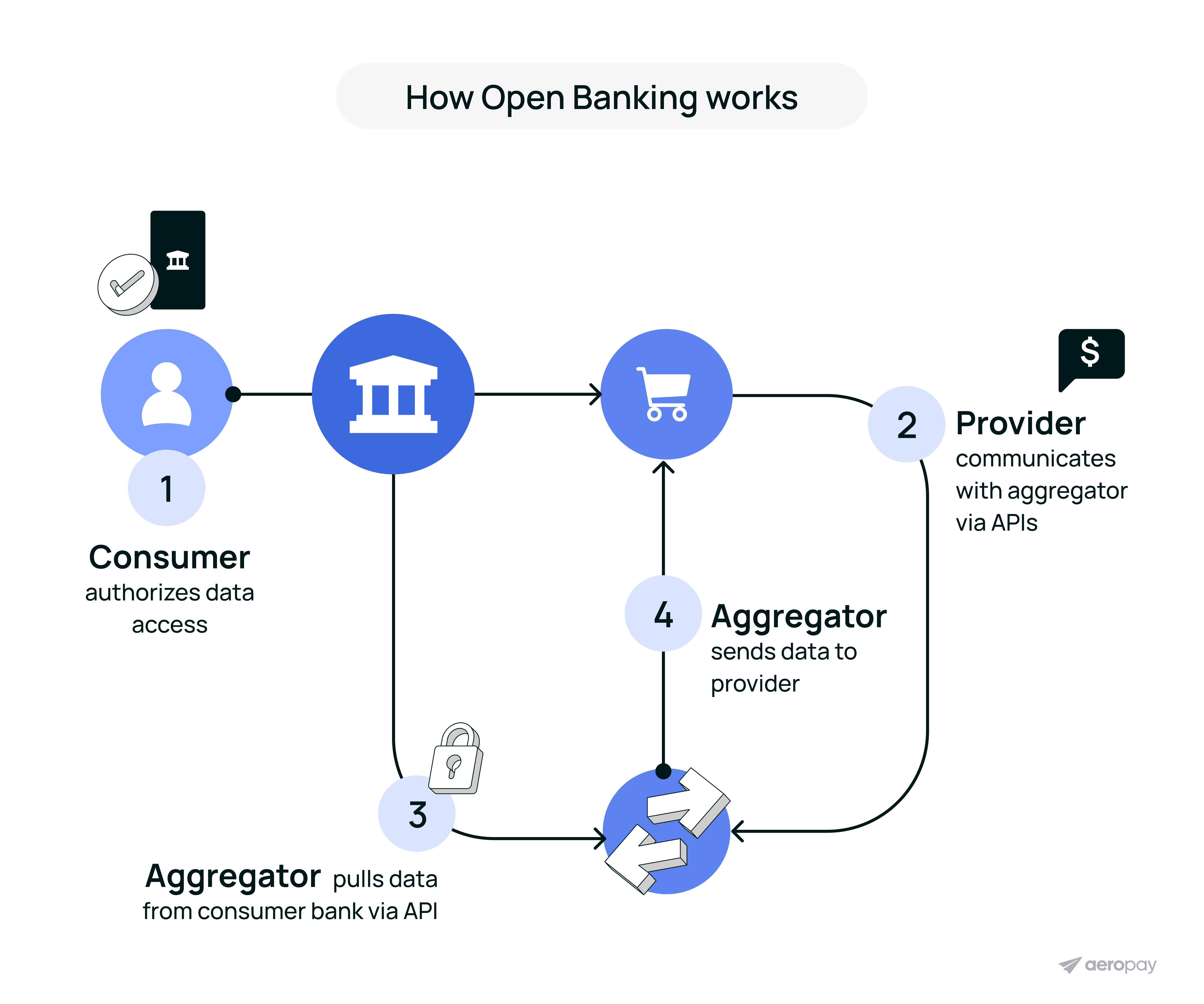

Establishing a connection between consumers and third-parties requires an intermediary, called a “bank aggregator” or “data aggregator.”

Bank aggregators are the connective tissue in open banking, allowing consumers to authorize third-party apps to access their financial data from various banks.

This is done either via;

- Screen scraping, or

- Application Programming Interface (API)

Screen scraping refers to the process where automated scripts (like web crawlers) log into a user's bank account with their credentials, extract the displayed financial data, and use it elsewhere.

APIs are a set of rules and standards that allow applications to communicate and share specific data directly through dedicated endpoints. API-based aggregators, like Aerosync, allow consumers to quickly log in to their bank directly, establishing a secure, live connection.

Screen scraping is widely criticized due to growing concerns over security, privacy, and the reliability of data.

The Consumer Financial Protection Bureau (CFPB) has recognized these risks in its proposed rulemaking to implement Section 1033 of the Dodd-Frank Act. While the rule does not outright ban screen scraping, it clearly disfavors the practice, requiring a transition to more secure, API-based data sharing.

Read more about Section 1033 later in this article.

Who benefits from open banking?

While not everyone is (entirely) familiar with open banking, many Americans care deeply about the issues surrounding the concept, like data security, data sharing convenience, and financial inclusion.

In the United States, open banking provides benefits to a number of stakeholders, including consumers, fintech companies, traditional banks, and even the broader economy.

Consumers

Open banking gives consumers better control over their financial data. They also see improved options for how they may choose to use their data, with solutions like instant payments, financial management tools, and feeless ACH rent payments—improving the customer experience.

Merchants

Open banking provides merchants with considerable cost savings via pay-by-bank methods. Aeropay data found pay-by-bank is up to 72% more affordable than cards.

Open banking payments include additional merchant benefits such as:

- Faster payments

- Reduced fraud

- Lower chargebacks

- Durable payment info

- And more! See details in our pay-by-bank guide

Fintechs

Open banking levels the playing field for fintech companies, meaning new market entrants can compete with large, established banks by offering niche or more agile services.

Traditional banks

While open banking increases competition, it also opens up new avenues for banks to collaborate with fintech firms. By partnering with fintech companies, banks can integrate new technology and offer enhanced services to their customers.

Small businesses

For smaller, emerging businesses and startups, open banking offers lower fees associated with payments. It also adds new initiatives and solutions to support financial management, invoicing, and other operational aspects of entrepreneurship.

The economy

Open banking improves access to financial services for underbanked populations by making it easier for fintech companies to offer affordable and accessible banking alternatives.

Faster, more transparent payments also improve financial inclusion by combatting junk fees, speeding up access to funds, improving data accessibility, and more.

.png)

Read more about open banking and financial inclusion.

Use cases for open banking

Open banking is a wide-ranging framework with the potential to touch and disrupt many aspects of a nation’s industries, standards, operations, and more.

It’s not a single financial product or service, but rather a system which financial services are built upon. The scope of these services are continuously evolving alongside new use cases.

For example, when it comes to payments and money movement, open banking plays an important role in the development of new, advanced solutions — particularly when it comes to the way consumers pay or get paid.

Open banking payments

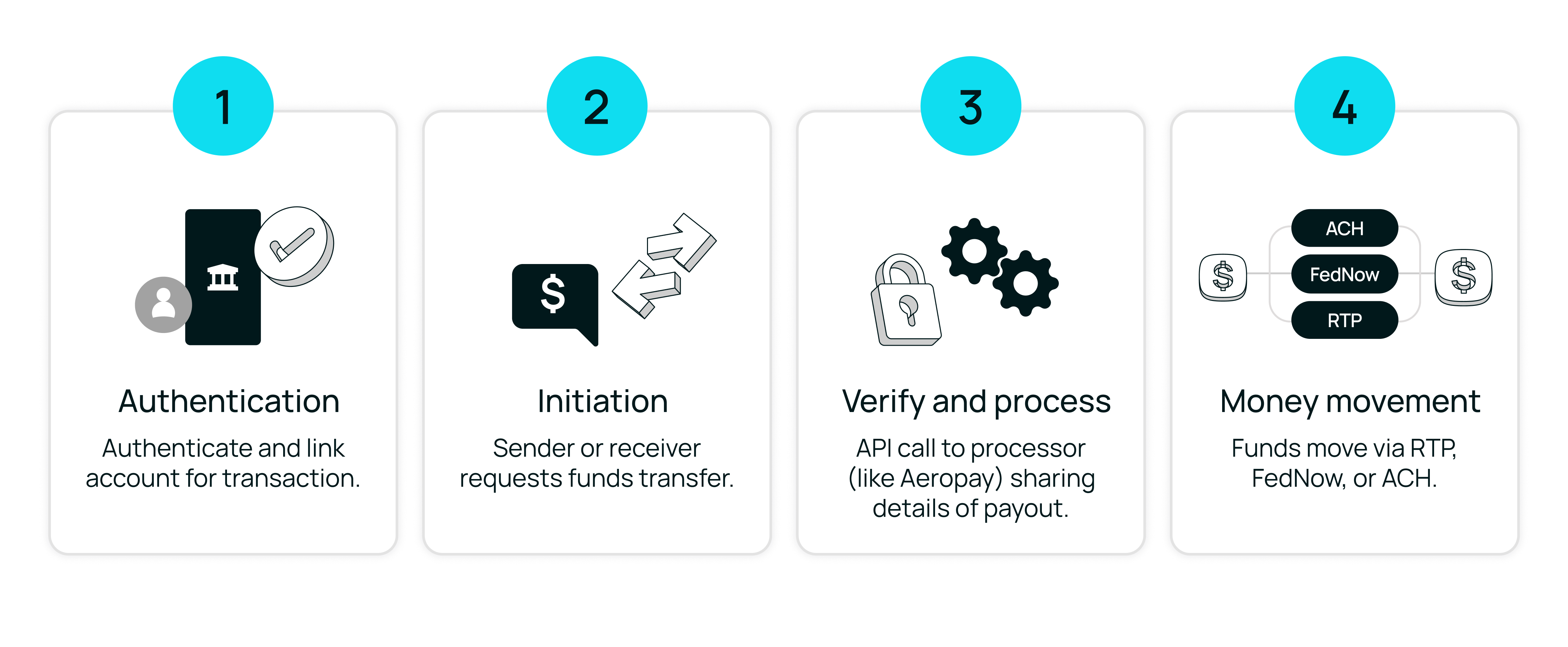

Open banking payments move funds between bank accounts using APIs to authorize and initiate the transfers. This process is called pay-by-bank or account-to-account payments.

Open banking payments are enabled with a third-party provider, like Aeropay, which establishes a secure connection between consumer bank accounts and merchants via API.

Once a bank is connected, funds may be debited (sent from consumers) via ACH rails or credited (sent from merchants) using real-time rails like RTP or FedNow.

In the United States, open banking payments are already used by 36% of consumers for use cases like:

1. Recurring payments. Once authorized, consumer payments for subscriptions, rent, or utility bills can be set for auto payment via bank transfer — offering a low cost, fast processing alternative to debit or credit.

2. Instant payouts. Real-time payouts can be sent from businesses to consumers for rewards, refunds, invoice payouts, pensions, or withdrawals from their platform.

3. Guaranteed payments. Some pay-by-bank providers shoulder the risk of returned payments by guaranteeing funds will be delivered.

4. Real-time fraud detection. Continuous monitoring to detect and respond to suspicious activity in real time is paired with open APIs to prevent fraud, chargebacks, and risk.

Open banking payments are rising in popularity in the US because they’re a simple solution to traditionally complex and expensive payments.

Merchant benefits of open banking payments include:

Lower cost

When consumers choose pay-by-bank, merchants avoid interchange fees, significantly lowering transaction fees compared to traditional credit, debit cards or even digital wallets. This is the biggest advantage of A2A payments.

In 2023, US merchants paid $101 billion in Visa and MasterCard credit card processing fees, including $72 billion in interchange fees. Most merchants are paying a hefty 2-5% fee for each credit card transaction — and that number’s been increasing.

Open banking payment fees are much lower. See a full cost comparison here.

.png)

Better control

Open banking ensures transparent data control between financial institutions, merchants, and third-parties. Merchants can access real-time data directly from consumers’ banks, which enhances the authentication process and reduces the risk of fraud.

Merchants are also able to easily verify account information, such as account balance, which ensures funds are available.

At the same time, merchants can set up effective processes to limit fraudulent transactions, alongside typical processor risk mitigation practices like bank-level authentication and multi-factor authentication (MFA).

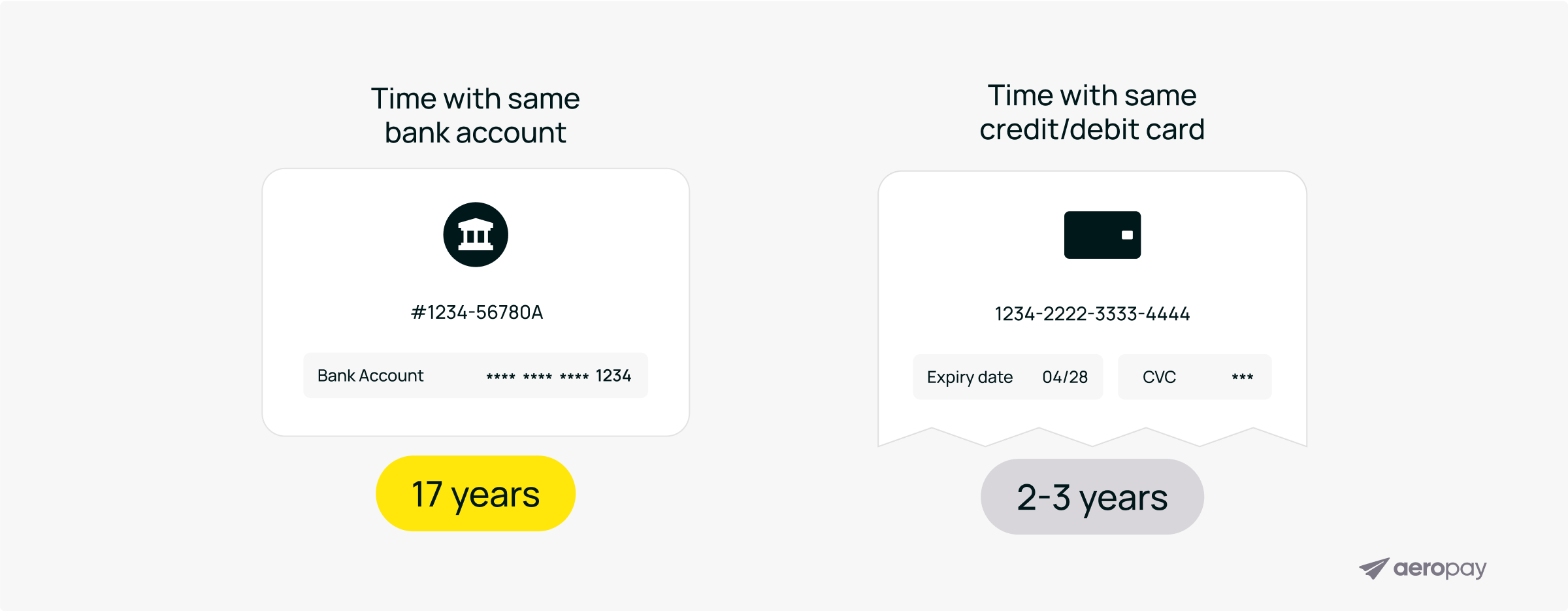

Durable payment information

Traditional cards expire every three years on average. And many consumers lose or replace them even sooner.

On the other hand, US adults use the same primary checking account for more than 17 years on average.

For subscriptions, bill payments, or more reliable e-commerce account transactions, there’s immense value in durable financial information to reduce payment churn and minimize chargebacks.

Consumers don’t have to add new card details every time they’re updated. Instead, a single bank link connects an account for every future transaction.

More examples of open banking

Other emerging US open banking services include:

- Account aggregation. Open banking allows financial management firms to pull in data from multiple sources, like checking and savings accounts, for a complete view of user finances and budgeting tools.

- Lending decisioning. Lenders have instant access to robust user data for identity verification, bank account info, and income/employment verification.

- Open finance. Financial services and digital banking apps can access consolidated financial data from multiple sources to offer personalized insights, balance checks, and more. This direct line between consumer and service creates a new category often referred to as “open finance.”

Deep dive: Open banking in the United States

The open banking initiative in the US is still in its early stages, but it’s quickly gaining momentum. One report from Deloitte revealed only 1 in 3 consumers currently feels "in control" of their financial data, a sentiment that underscores the need for open banking’s improved transparency and control.

As open banking regulations evolve, the initiative is expected to accelerate and impact banking, payments, and financial industries.

Here’s everything you need to know about what’s coming next with open banking in the United States:

Section 1033 will accelerate US open banking

Section 1033 of the Dodd-Frank Act is considered the “open banking rule” for the United States.

This rule, set forward by the Consumer Financial Protection Bureau (CFPB), was first conceived in 2016 and is set to take effect in Fall 2024.

If Section 1033 is implemented as currently outlined, it will:

- Mandate open banking for checking and savings accounts.

- Require the use of application programming interfaces (APIs) along with a developer interface.

- Accelerate the elimination of screen scraping and credential sharing.

- Provide clear guidelines on the specific transaction data banks are obligated to make accessible.

While the CFPB’s proposed rule is expected to take effect soon, financial institutions aren’t expected to adopt open banking right away. Larger banks and FIs must adopt these open banking standards within 6 to 12 months, with smaller banks and credit unions following in phases.

US open banking will be an industry-driven initiative

Unlike the government-led directives in Europe (PSD2), the US will take an industry-driven approach to open banking, allowing the market to determine standards, with guardrails from the CFPB.

Because the US has many more financial institutions than European nations or peers like Australia, Brazil, and India, it’s harder to create a one-size-fits-all standard. The US process has been deliberate, balancing the needs of incumbents alongside new entrants.

FDX standards are expected to be adopted

The US is expected to adopt open banking API standards set by the Financial Data Exchange (FDX).

FDX is dedicated to unifying the financial industry around a common standard for the secure and convenient access of permissioned consumer and business financial data. As of this year, 76 million consumers use the FDX API for data sharing.

Adoption of FDX standards will ensure the US open banking ecosystem is not only secure but also interoperable, providing clear protocols for seamless data sharing across the financial services industry.

Aeropay’s involvement in the future of US open banking

Aeropay has proudly taken leadership and subsequently influenced the FDX task force on UX for data aggregators.

Through UX research, user testing, and collaboration with some of the most influential players in financial data access, we have created recommendations for ideal user experience as a new standard to be set for all data aggregators and data providers.

Partnerships between Aeropay and FDX ensure emerging open banking products are in line with the trajectory of US regulations and data protection requirements.

Aeropay’s mission is to embrace the future, not get stuck in the status quo. We're focused on complying with 1033 and FDX standards to balance access with responsible data management.

Learn more about our proprietary bank aggregator, called Aerosync, and see how it’s positioned to evolve alongside the US open banking model. Read now.

For more information about Aeropay’s open banking payment services, schedule a call with our team.